General Overview and Facts and Figures

As one of the most advanced ecommerce markets in Latin America, Brazil is expected to continue to flourish over the next few years. Presenting many opportunities for businesses that wish to penetrate this market, the Brazilian eCommerce space also brings about specific complexities.

During the last couple of years, cross-border ecommerce revenues registered fantastic growth – and the trend continued over the past 12 months, with the cross-border transaction value increasing by 92%. Mobile payments accounted for 13% of all eCommerce traffic, compared to desktop devices which accounted for 87%. Despite the ratio of mobile payments compared to desktop payments being low, the value of mobile transactions has increased by 111%. All these developments are proof that the payments and ecommerce ecosystems in Brazil are experiencing

great changes, and in order to grasp this opportunity, digital players should definitely consider them before entering this market.

In this report, which is based on data from ACI and produced in association with The Paypers, we will analyze the local payments and eCommerce space by having a closer look at the main trends and developments in how people shop and pay online in Brazil.

The eBook is intended as a snapshot of the insights that matter most when measuring the size and type of opportunities in the eCommerce market in Brazil. Read on to discover the trends that are here to stay, the factors driving eCommerce, how lockdowns influenced this space, and the main insights into market readiness for vCommerce, crypto payments, and the introduction of Central Bank Digital Currencies (CBDC).

2 / 26

| 0-14 | 15-64 | 65 and above | |

| 2011 | 24.3% | 69.7% | 7% |

| 2021 | 20.5% | 69.6% | 9.9% |

Banked Population

(% aged 15+)

88%

Smartphone Penetration

(per 100 persons)

55.4%

Smartphone Penetration by Age Group

| GenZ & Millennials | 18-24 | 35-49 | 50 and above |

| 85% | 63% | 32% |

3 / 26

The Local eCommerce Space and Avenues for Online Shopping

Some of the most relevant factors driving online purchases in Brazil are cheaper prices, a greater product range, the possibility to avoid crowded places, and the overall more convenient way of comparing and choosing products. Therefore, convenience is king for Brazilian shoppers – and the most valued advantage of online shopping, according to Statista’s survey carried out in 2022, is direct delivery to their homes.

In terms of the main online avenues for merchants in Brazil, both search engines and social networks are popular, but it depends mostly on various ecommerce segments whether users prefer one or the other. For instance, furniture and appliances are reached mainly through search engines, whereas fashion and accessories, through social media.

4 / 26

Brazilian Consumers’ Preferences in Terms of Online Shopping

Of all the product categories available online, the most popular ones include electronics and media, accounting for 27% of the eCommerce revenue in Brazil, fashion and accessories with 22%, toys, hobbies and DIY with 19%, furniture and appliances with 17%, and food and personal care with the remaining 16%. The latter category of products available online registered significant growth particularly in 2021.

When we take a closer look at the online stores that are most popular in Brazil, we see that many of them are local players, such as Americanas, Magazine Luiza, or Casas Bahia. Magazine Luiza, one of the biggest ones in the Brazilian eCommerce market, had a revenue of USD 3.2 billion in 2021, followed by Casas Bahia, with USD 2.2 billion, and Americanas, with a revenue of USD 2 billion. EcommerceDB estimates that in 2021 these three stores accounted for 30% of online revenue in Brazil.

EcommerceDB estimates that in 2021 Americanas, Magazine Luiza and

Casas Bahia accounted for 30% of online revenue

in Brazil.

5 / 26

Major Online Shopping Events

One of the major factors driving eCommerce growth in the region is represented by seasonal retail dates which drive sales and attract new digital consumers each year. Some of the most relevant buying holidays in Brazil follow some particularities – and others, including Black Friday, Christmas, Easter, Mother’s Day, Father’s Day, and so on, follow global trends. In the last decade, these shopping events have proved to be a hit, breaking sales records every year.

Merchants who want to successfully penetrate the Brazilian market and build strong relationships with customers should consider these peak shopping periods – especially Consumer’s Day and Free Shipping Day. Consumer’s Day takes place on 15 March, and it has become a wellknown event in the country due to the major discounts that are available in the first quarter of the year. Another important factor for Brazilian shoppers in choosing to purchase online is the cost of shipping, hence the popularity of Free Shipping Day, which takes place on the last Friday of April and allows them to buy online without paying for products’ delivery.

Consumer’s Day

takes place on

15 March

6 / 26

Sector Trends and

Cross-Border Shopping

When looking at the main trends per sector, ticketing and travel bookings are still going strong in Brazil. During the last twelve months, ticketing transactions have increased by 438% and travel by 139%. The travel sector also experienced a 15% (USD 126) growth in average transaction value (ATV). Since the end of the COVID-19 pandemic restrictions, there has been a pent-up demand for travel, as bookings experienced a 159% increase in domestic transactions, with the value of transactions reaching a 248% growth. Even with the current inflation, consumers seem to be increasing their discretionary spending.

In the retail sector, Brazil registered an overall 8% decrease in the volume of transactions, but the basket size grew. The ATV has increased by 64% (USD 124) due to economic uncertainty, leading shoppers to purchase more products to avoid inflated prices at a later stage. Cross-border

eCommerce transactions in the retail sector also experienced a 38% growth in transaction volumes, with the ATV decreasing by 7% (USD 19).

The Brazilian telco sector experienced a 4% increase in the volume of transactions, with the ATV growing by 13% (USD 6). This is likely due to the technological advancements leading consumers’ spending to increase as they hope to enjoy specific benefits.

Overall, Brazil recently experienced a 112% growth in transaction values. Consequently, merchants implemented more fraud prevention measures, which reduced the number of approved transactions – however, the ATV increased by 163%. More specifically, domestic transaction values grew by 150%, and cross-border transaction values increased by 92%. Meanwhile, cross-border average transaction values reached a 230% growth (USD 337).

7 / 26

The Local Payments Space

One of the most relevant developments in Brazil’s payments landscape is represented by the introduction of Pix, a multi-purpose open instant-payment scheme developed by the Central Bank of Brazil with the aim of making banking and consumer interactions more inclusive.

Pix became fully operational on 16 November 2020, and it was adopted quickly and massively by both users, for whom it is free of charge, and merchants. Today, Pix is already among the top 3 preferred payment options in Brazil – ahead of e-wallets, debit cards, and bank transfers.

Due to the increasing popularity of Pix, among other factors, in 2021, Brazil recorded 8.7 billion real-time transactions, and the widespread adoption of this payment method led to estimated cost savings of USD 5.7 billion for businesses and consumers. Moreover, with the upcoming functionalities of Pix – such as international or recurring payments – we expect to see further growth and an increase in ATV.

9 / 26

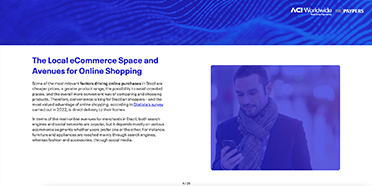

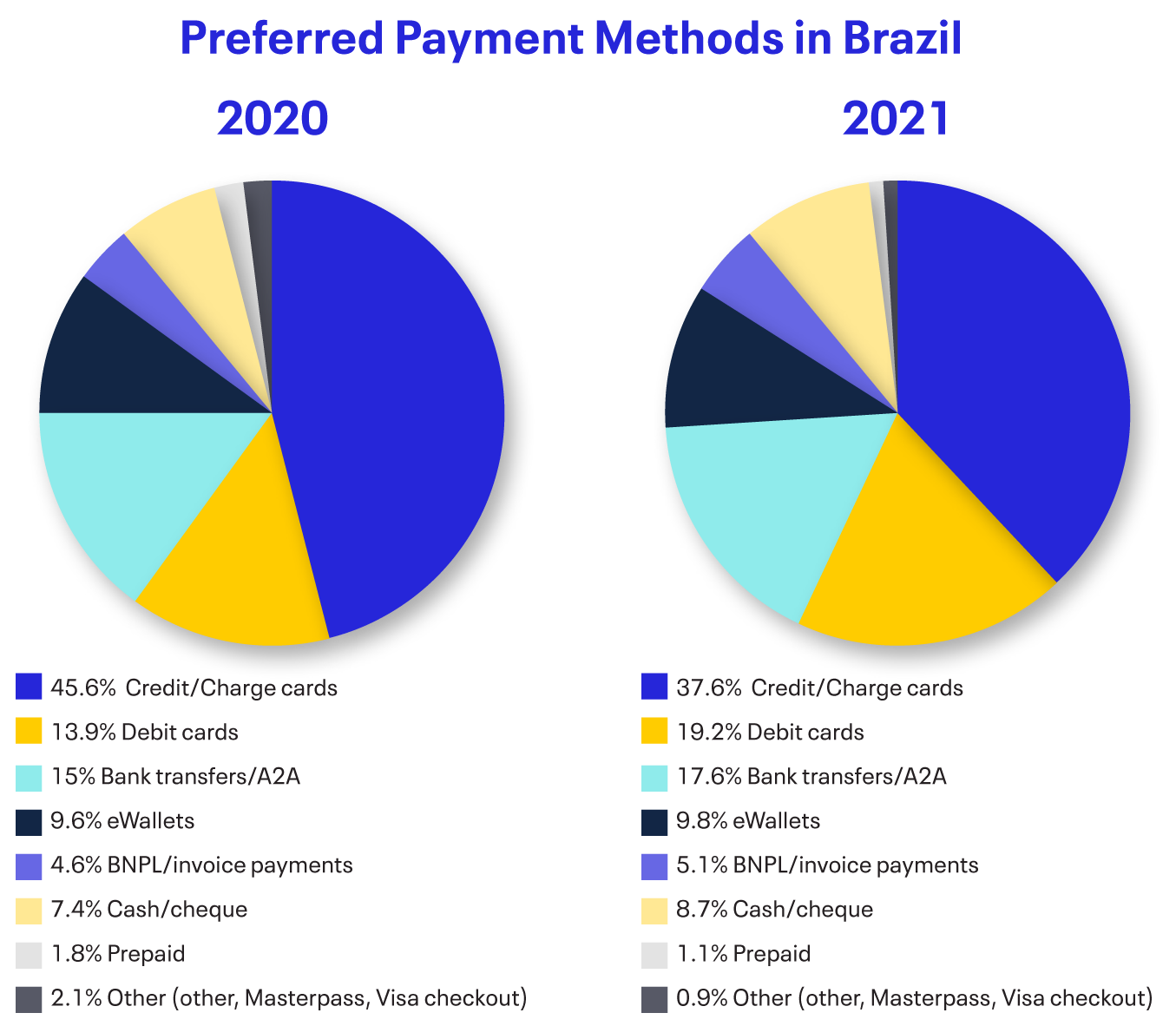

Relevant Payment Methods

and Channels

The Brazilian market saw a decrease in the volume of transactions for credit and debit cards. However, as shoppers tend to reduce their purchase frequency and increase their basket sizes, this has resulted in an increased ATV by 57% (USD 127). Although the rise of ATV could be seen as a result of inflated prices, this could also be explained by shoppers increasing their discretionary spending over mandatory spending. Owing to mandates and compliance upgrades focused on shoppers’ security, ACI customers experienced a 3% increase in approval rates in 2022 compared to H1 2021.

On the other hand, payment methods such as Buy Now, Pay Later (BNPL) and e-wallets have risen in popularity in the Brazilian market. One of the reasons behind the increased use of e-wallets is Brazilians’ concern over fraud targeting credit and debit cards – which led them to opt for a payment method that provides only tokenized details of their financial identity.

When it comes to the payment channels preferred by Brazilian online shoppers, mobile payments accounted for 13% of all eCommerce traffic, compared to desktop devices which accounted for 87% of eCommerce traffic. Despite the ratio of mobile payments compared to desktop payments being low, the value of mobile transactions has increased by over 2X (111%). This was primarily driven by the domestic value of transactions increasing by 133%.

10 / 26

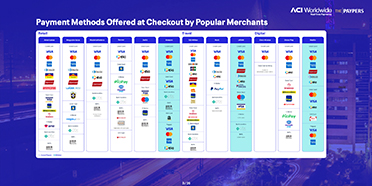

Popular Retailers – Return Policy and Fees for Brazilian Consumers

Name

Return Policy

Timeline

Return Cost (responsibility)

| Americanas | Magazine Luiza | MadeiraMadeira | Renner | Dafiti | Amazon |

|---|---|---|---|---|---|

| 7-30 days (longer for bags, shoes and clothes) | 7 days | 7 days | 7 days (30 to exchange) |

60 days | 7 days |

| Free for consumer |

Free for consumer |

Free for consumer |

Free for consumer |

Free for consumer |

Free for consumer |

Popular local brands

Global brand that is also popular in Brazil

12 / 26

Logistics, Refunds and Return Policies

Delivery preferences and channels

Consumers in Brazil have clear preferences when it comes to how and when they want to have their online purchases delivered to them. According to Statista, 66% of surveyed Brazilian online shoppers stated that getting their package delivered on the weekend was the most important option they could have regarding the delivery of purchased items, and 59% claimed that they would like to benefit from same-day delivery. Other important factors for Brazilian online shoppers are being able to choose the pick-up location and having the option to get their purchased goods delivered on Saturday.

As the fifth largest country in the world, Brazil’s geography may lead to logistical issues that ecommerce companies must be aware of. These challenges – that range from regions with no coverage from delivery

companies to regions with unsafe product deliveries – must be taken into account by merchants wanting to expand in this market, and in order to be successful, they must collaborate with both domestic and international logistics companies.

Brazilians have also been exploring different delivery channels, as there has been an increase in popularity for BOPIS/Click & Collect. The volume of transactions being picked up in-store increased by 53%, and the value of transactions increased by 223%. The ATV increased by 2X (USD 438) as a result of increased demand over inflated prices. As one of the safest choices for delivery, ACI customers experienced a chargeback rate of 0.07%.

13 / 26

Refunds and return policies

The Brazilian Consumer Code provides the consumer the option to withdraw from the purchase of a product or service for purchases made via Internet, but it does not apply to purchases made in a physical store. The Brazilian Consumer Protection Code was introduced in 1990, and since then, it has been updated several times.

Besides having the right to withdraw from the purchase of physical and digital goods bought online, Brazilian customers are entitled also to compensation for any wrongful charges. They have the right of retraction within 7 calendar days from the date of signature of the agreement or from the day they receive the product or service sold. If consumers decide to exercise this right, they should be reimbursed by the seller promptly for the returned products and other transaction costs (expenses with postal services for returning the product and the monetary restatement).

14 / 26

eCommerce at the Cutting Edge: Social Commerce, vCommerce and Cryptocurrencies

The social commerce opportunity

In 2021, approximately 70% of the Brazilian population was on social media (150 million social media users). The number of users is estimated to have increased by about 7% (10 million) between 2020 and 2021, and data from Q3 2021 shows that the most popular social media platforms in Brazil by usage are WhatsApp (96.4%), Instagram (90.1%), Facebook (88.2%), and TikTok (69.9%).

By August 2021, approximately 26.5% of the consumers had made a purchase on social media live streams intended for eCommerce. Furthermore, the credibility of social media influencers in Brazil has reached more than 75%, and they are expected to continue using live streams to drive up social commerce sales. Social media commerce in Brazil is expected to grow by 44.9% and reach USD 2.2 billion by the end of 2022.

The most popular social media platforms by usage are

WhatsApp (96.4%),

Instagram (90.1%),

Facebook (88.2%),

and TikTok

(69.9%).

15 / 26

The future of AR/VR technologies

A study in 2017 found that 73% of interviewed consumers had an interest in shopping using augmented reality (AR) and virtual reality (VR) technologies in Brazil. What is more, another more recent study projected that between 2020 and 2023, investments in virtual transformation technologies such as AR and VR in Brazil should exceed BRL 4.9 billion (around USD 960 million).

Companies such as R2U offer AR/VR solutions to other companies, including retailers such as Mobly and Wood Prime. These two companies that sell furniture have implemented already AR features for their online sales – Mobly has created a phone app that shoppers can use to visualize items in their home, while Wood Prime has implemented 3D and AR models of furniture that customers can personalize and visualize in their chosen environment via a QR code that passes the image from a computer device to a phone.

Smaller initiatives to incorporate AR technology into sales have also been undertaken, such as when Lojas Renner partnered with Snapchat to create filters that allowed people to visualize how certain pairs of shoes would look on them.

Investments in virtual transformation technologies such as AR and VR in Brazil

should exceed

BRL 4.9

billion (around USD 960 million).

16 / 26

Welcome to the metaverse

Brazilians also seem eager to join the metaverse. Banco do Brasil (BB) has joined a platform called GTA RolePlay, on a server called Complexo, where actions in the real world can be transferred to the digital – and vice versa. BB has two buildings in the virtual world, where customers can drive to and open bank accounts or receive benefits, actions that will be replicated in the real world.

Lojas Renner has also joined the metaverse through the game called Fortnite, offering visitors a virtual map of a store with games built into it and QR codes that players can scan to redirect them to Renner ecommerce sites, where players can purchase items from their collections.

17 / 26

The complexities of crypto and CBDCs

Finder estimates that 14,4% of Brazilians own cryptocurrencies, placing them in 17th place globally for crypto ownership. A global study by Visa shows an even higher figure, stating that about 34% of respondents to their survey own cryptocurrency. The most commonly owned cryptocurrencies in Brazil are Bitcoin (28,4%), Solana (23,4%), and Ethereum (20,4%), and the age demographic of crypto users in Brazil shows that younger people are more interested in this payment method: about 61,9% are between 18 and 34 years old, 20.4% are between 35 and 54 years old, while only 17,6% claim to be over the age of 55.

In Brazil, it is possible to buy goods and services using cryptocurrencies at a number of stores, and you can even pay your Boleto using crypto through an intermediary such as Kamoney, PagueComBitcoin e BitBol. Some of the places where you can purchase items and services with Bitcoin in Brazil are

NoWear, UltraFitness (fitness supplement sales), Las Magrelas (a bicycle shop), Tony Veículos (for used cars purchase), and Malabarize-Se (for circus items such as juggling tools).

In 2022, Brazil has made several moves toward joining the cryptocurrency frenzy, from introducing new regulations to launching a pilot for a Central Bank Digital Currency (CBDC). The Federal Senate also approved a project that regulates cryptocurrencies in Brazil, and a law passed by the Federal Revenue of Brazil (RFB) will require investors to pay personal income tax when they exchange one digital currency for another. They have capped the reporting requirement at transactions that exceed BRL 35,000 (about USD 7,200). The Brazilian Securities and Exchange Commission (CVM) will be the body overseeing initial coin offerings (ICOs), while regulators for other aspects of the market have not yet been identified.

18 / 26

Unpicking the Fraud Factor

Brazil is one of the regions with the highest concerns regarding card testing, ID theft, and Phishing/Pharming/Whaling. With an upgrade in the mandates and an enhanced fraud management solution for merchants, the country has seen an 8% decline in fraud attempts. Issuing banks are slowly keeping pace with supporting technical abilities, and the transaction approval rates have also experienced a 2% decline.

As Brazilian shoppers increased their purchase values, there was a 1% growth in fraud attempts arising from cross-border transactions, while domestic transactions experienced a 15% decline in fraud attempts. Mandate upgrades led to increased security around transactions and a 4% improvement for credit and debit card transactions, with a 10% increase in approval rates for cross-border transactions.

As e-wallets become a hub to store tokenized bank or card details, Brazilian shoppers showed a higher affinity for e-wallets, resulting in an 18% increase in approval rates. This was accompanied by an 11% decrease in fraud attempts majorly arising from domestic e-wallet transactions.

Mandate upgrades

led to a

10%

increase in approval rates

for

cross-border

transactions.

19 / 26

The fraud component – payment channels and delivery methods

In Brazil, mobile devices experienced a 4% decrease in fraud attempts for cross-border transactions and a 2% decrease in combined (domestic and cross-border) mobile transactions. ACI customers are experiencing a 0.03% decline in chargeback rates.

Desktop devices, on the other hand, experienced a 9% drop in fraud attempts for both cross-border and domestic transactions. Driven by mandates and enhanced fraud management solutions, cross-border transactions experienced a 16% decrease in fraud attempts.

As BOPIS/Click & Collect becomes popular among Brazilian shoppers, it also experiences a 3% increase in fraud attempts. Merchants need to be more aware of cross-border transactions opting for BOPIS as they experience a 6% increase in fraud attempts

Merchants need to be more

aware of cross-border

transactions opting for BOPIS

as they experience a

6%

increase in fraud attempts.

20 / 26

Fraud attempts per eCommerce sector

The travel sector registered an overall 5% decrease in fraud attempts. This is due to genuine transactions outpacing fraudulent transactions, as shoppers increasingly prefer to spend more on new experiences. ACI customers experienced a 0.03% chargeback rate. Ticketing registered a 1.4% decrease in fraud attempts, with a 3.5% decrease in fraud attempts for domestic transactions.

In Brazil, retail experienced a slight 1% decrease in fraud attempts, mainly arising from cross-border transactions with a 3.2% decrease in fraud attempts. Meanwhile, there was a 1.4% increase in fraud attempts for domestic transactions.

The gaming sector in Brazil experienced a significant 7% decrease in fraudulent transactions, primarily owing to new mandate upgrades. As for most online gaming transactions, a shopper’s sensitive information is stored on their profile as tokenized data, making it easier for genuine transactions to outpace fraudulent ones.

The travel sector registered

an overall

5%

decrease in fraud attempts.

21 / 26

Talking Payments: Interview with Renato Gomes, the Deputy-Governor for Licensing and Resolution of the Central Bank of Brazil

Renato Gomes is the Deputy-Governor for Licensing and Resolution of the BCB. Among other responsibilities, he oversees the Central Bank’s competition and innovation policies. Born in the city of Rio de Janeiro, Renato holds a bachelor’s and master’s degree in Economics from PUCRJ, a PhD from Northwestern University, and an HDR from the University of Toulouse. Before joining the Central Bank, he was Professor at the Toulouse School of Economics and Senior Researcher at the “Center National de la Recherche Scientifique” (France).

What can you tell us regarding Pix’s reach? How many users does it already have and what is the typical user profile?

Pix is a multi-purpose open instant-payment scheme, powered by a neutral platform developed and operated by the Central Bank of Brazil (BCB). The user experience with Pix is the same across Payment Service Providers (PSPs), which must adopt the same brand for the service.

Pix can be employed to make transfers between people, companies, or the government. Since its launch in November 2020, Pix enjoyed widespread adoption across all regions, age groups, and income groups in Brazil. Adoption was higher and faster among young people, who are typically more familiar with technology.

By December 2021, around 61% of the adult population had at least one registered Pix alias. Around 100 million people made at least one payment with Pix – and more than 2.0 billion transactions were made in July 2021 using Pix, 72% of which are among individuals.

22 / 26

Does the BCB work directly with merchants or via PSPs? What costs does the merchant support for offering Pix?

The BCB does not serve end users, but provides an infrastructure that banks, non-bank financial institutions, and e-money issuers use to offer Pix to end users (consumers and merchants).

Pix offers an easy and cheap payment instrument to the general population. To guarantee widespread adoption, the BCB mandated that all authorized institutions with more than 500 thousand accounts (including deposits, savings, and pre-paid accounts) should offer Pix. Nowadays, almost 800 PSPs are connected to the Pix platform. Its open architecture levels the playing field between incumbents and entrants.

The BCB adopts a recovery-only policy, charging BRL 0.001 per transaction (roughly USD 0.0002) from the receiving PSP (transactions within accounts in the same PSP are not charged by the BCB, as it amounts to an internal book transfer). The BCB mandates financial and payment institutions with

more than 500,000 accounts to offer Pix, which ensures that a substantive part of the ‘supply side’ is ‘onboard’. Facing this competitive pressure, other financial institutions, from traditional to neo-banks, fintechs, and credit unions, also joined Pix.

By regulation, Pix is free of charge to transactions between individuals. However, PSPs are allowed to charge firms fees for both sending and receiving Pix transactions. These fees are lower than those of other payment instruments (e.g., debit or credit cards), due to both the intense competition among Pix participants and the fact that the Pix infrastructure is provided at cost by the BCB.

What sets Pix apart from the competition?

By design, Pix is an instant payment method, available 24 hours, affordable to people and firms, and accessible to any PSP. The objective of the policy behind Pix is not to compete or displace other payments instruments, but rather increase the efficiency of the payment sector in Brazil.

23 / 26

What are the fees for using Pix (processing fees, late fees, and so on), and who supports them?

Individuals generally do not pay to receive or send money through Pix. Firms, however, may be charged by the PSP to make or receive a transfer through Pix. In a transaction, only the sender or the receiver will pay the fee (Pix rulebook explains in which situation the payer or the payee can be charged).

What are the typical credit acceptance rates you see with shoppers?

We do not have statistics on acceptance rates on Pix, but we have seen increasing use of Pix by eCommerce. Some studies already suggest that about 80% of eCommerce sites offer Pix, and about 25% of them offer discounts ranging from 3% to 10% for payments with Pix. This movement reflects, in part, a growing demand from customers to use Pix in payments. Although we do not have statistics collected on Pix’s acceptance rates, its expansion on eCommerce is evidence that adoption by merchants is probably growing.

In 2022 and beyond, what do you think will be key to staying ahead of the game? Can you offer us a glimpse into the BCB’s plans for the near future?

I see a great future for tokenization technologies. The digital representation of assets, in a secure (encrypted) way, tends to gain space in daily transactions. The BCB aims to expand Pix’s use cases and, in parallel, develop its CBDC, which we call ‘Real Digital’. With the CBDC, we shall guarantee scalability, interoperability, and privacy in the financial system, while creating the conditions for new services to be offered (e.g., programmability and tokenization).

In the meantime, we are advancing fast with Open Finance in Brazil, which is another vector of innovation and competition in the financial system. The BCB will play an important role in this innovative environment, welcoming new business models with proportional regulation, promoting transparency, inclusion, and data protection.

24 / 26

About the Central Bank of Brazil

The Banco Central do Brasil (BCB) is Brazil’s monetary, regulatory, and supervisory authority. Its mission is to preserve the purchasing power of the currency, to foster a sound, efficient, and competitive financial system, and to promote the economic well-being of society.

25 / 26

Want to learn more about capitalizing on the growth of eCommerce in Brazil?

Talk to ACI’s eCommerce consultants today, to discover winning payments and fraud management strategies for the new normal of eCommerce.

Sources

- Brazil, IMF, Statista -

https://www.cnmc.es/sites/default/files/editor_contenidos/20220107_NP_CE_II_21_eng.pdf

- Statista: Digital market outlook -

https://www.statista.com/forecasts/625406/smartphone-user-penetration-in-brazil

- Brazil, Statista; 2013-2018 -

https://www.statista.com/forecasts/1150418/online-banking-penetration-forecast-inbrazil

- Source: Brazil, World Bank -

https://www.statista.com/statistics/270806/age-structure-in-brazil/

- LAC; Indra Sistemas; Minsait; The Cocktail Analysis; Analistas Financieros Internacionales; June

and July 2019; 400

per country; internet users with at least one financial account -

https://www.statista.com/statistics/1188511/latinamerica-

banked-population-internet-users/

- Newzoo -

https://www.statista.com/statistics/539395/smartphone-penetration-worldwide-by-country/

- Source: PagBrasil.com - https://www.pagbrasil.com/news/mobile-in-brazil/

- Brazil Economy & Society - https://www.statista.com/study/48362/brazil/

- Data Reportal - DIGITAL 2021: BRAZIL - https://datareportal.com/reports/digital-2021-brazil

- Statista - Most popular social media platforms in Brazil as of 3rd quarter 2021, by usage reach -

https://www.statista.

com/statistics/1307747/social-networks-penetration-brazil/

- Radioagencia Brasil - Mais da metade das empresas brasileiras usam internet para vender e 78%

estão nas redes

sociais -

https://agenciabrasil.ebc.com.br/radioagencia-nacional/acervo/economia/audio/2020-04/mais-dametade-

das-empresas-brasileiras-usam-internet-para-vender-e-78-estao/

- Global News Wire - Brazil Social Commerce Market Report 2022-2028 -

https://www.globenewswire.com/news-relea

se/2022/05/12/2441735/28124/en/Brazil-Social-Commerce-Market-Report-2022-2028-Short-Video-Apps-are-

Partnering-with-Retailers-to-Launch-Live-Shopping-Services.html

- Canaltech - Compra em realidade virtual já é um desejo de 73% dos brasileiros -

https://canaltech.com.br/rv-ra/

compra-em-realidade-virtual-ja-e-um-desejo-de-73-dos-brasileiros-98113/

- Brasil Alemanha News - Pandemia impulsiona o uso das Realidades Virtual e Aumentada - https://brasilalemanhanews.

com.br/coluna-em-destaque/pandemia-impulsiona-o-uso-das-realidades-virtual-e-aumentada/

- R2U - https://r2u.io/

- Consumidor Moderno - Conheça o aplicativo da Mobly que usa realidade aumentada para vender móveis - https://

www.consumidormoderno.com.br/2017/09/04/mobly-aplicativo-realidade-aumentada/

- Wood Prime Blog - https://blog.woodprime.com.br/moveis-com-personalizador-3d-e-em-realidade-aumentada-nawood-

prime-experimente/

- Tiinside - Usando realidade aumentada, Renner lança provador virtual - https://tiinside.com.br/07/12/2021/usandorealidade-

aumentada-renner-lanca-provador-de-virtual/

- PRogramadores Brasil - Conheça 3 empresas brasileiras no metaverso - https://programadoresbrasil.com.

br/2022/03/conheca-3-empresas-brasileiras-no-metaverso/

- Banco do Brasil Blog - BB no metaverso: do mundo real para o virtual - https://blog.bb.com.br/bb-no-metaverso/

- Visa - The Crypto Phenomenon: Consumer Attitudes & Usage - https://usa.visa.com/dam/VCOM/regional/na/us/

Solutions/documents/the-crypto-phenomenon-technical-paper.pdf

- Finder - Índice de Adoção de Criptomoedas Finder - https://www.finder.com/br/indice-de-adocao-de-criptomoedasfinder

- Mercado Bitcoin - Como pagar boleto com Bitcoin, é possível? - https://blog.mercadobitcoin.com.br/como-pagarboleto-

com-bitcoin

- Renda Diaria - 10 Sites que Aceitam Bitcoin como Pagamento (Brasil e Exterior) - https://www.rendadiaria.com.

br/2018/03/sites-que-aceitam-bitcoin.html

- Coin Telegraph - 7 lojas e serviços no Brasil para comprar com Bitcoin nesta Black Friday - https://cointelegraph.com.

br/news/6-stores-and-services-in-brazil-to-buy-with-bitcoin-this-black-friday

- Silva Friere Advogados - As fraudes e a regulamentação dos CRIPTOATIVOS no Brasil - https://silvafreire.com.br/site/

noticias/as-fraudes-e-a-regulamentacao-dos-criptoativos-no-brasil/?pht=33361566223473796&gclid=CjwKCAjw4

6CVBhB1EiwAgy6M4u2xxeU_hAX056HXDUByfgudY_VegsiECn1geL7kDwNBLR93vP_VuxoCgaMQAvD_BwE

- The Paypers - Brazilian central bank confirms CBDC pilot will launch in 2022 - https://thepaypers.com/

cryptocurrencies/brazilian-central-bank-confirms-cbdc-pilot-will-launch-in-2022--1255832

- The Paypers - Federal Revenue of Brazil requires tax payments on digital currency transactions - https://thepaypers.

com/cryptocurrencies/federal-revenue-of-brazil-requires-tax-payments-on-digital-currency-transactions--1256698

- Drivers of online purchases in Brazil in 2022 - https://www.statista.com/forecasts/1226654/drivers-of-onlinepurchases-

in-brazil

- E-commerce Market Analytics, The eCommerce market in Brazil - https://ecommercedb.com/markets/br/all

- ACI Worldwide, Global Payments Report, Brazil - https://go.aciworldwide.com/Global-Payments-Report-brazil.html

- Preferred delivery options for online shopping in Brazil in 2017 - https://www.statista.com/statistics/1055082/

preferred-delivery-option-online-purchases-brazil/

- Pix is one of the most available payment methods in e-commerce - https://valorinveste.globo.com/produtos/servicosfinanceiros/

noticia/2022/08/08/pix-e-uma-das-formas-de-pagamento-mais-disponibilizadas-no-e-commerce.

ghtml

- PIX ties with slips for means of payment in e-commerce - https://www.abranet.org.br/Noticias/PIX-empata-comboletos-

para-meio-de-pagamento-no-comercio-eletronico-3988.html?UserActiveTemplate=site#.Y38moHZBxPZ

- The Right of Regret in the Brazilian Consumer Protection Code - https://www.acc.com/resource-library/right-regretbrazilian-

consumer-protection-code#

26 / 26